The Debt to Assets Ratio Best Answers Which Question

Whereas Incorporation gives limited liability over the individuals it protects the shareholders personal assets. From the above data set the 5 th and 6 th values are 33 40 respectively.

How Much Home Can I Afford In 2020 Mortgage Loans Mortgage Loan Calculator Debt To Income Ratio

The asset turnover ratio determines the ability of a company to generate revenue from its assets by comparing the net sales of the company with the total assets.

. Median 10 1 2. Comprehensive National Football League news scores standings fantasy games rumors and more. Since it is a legal office it makes money and pays taxes for it.

Ratio calculations can also help to make financial analysts to better understand whether the company is making the best use of its assets. The debt ratio is a financial ratio that measures the extent of a companys leverage. Ratio analysis can guide a company to know whether it is making good use of its assets and when it is not the case.

It is possible for a business to either over or under utilise its assets in its quest to maximise profits. For DU loan casefiles if a revolving debt is provided on the loan application without a monthly payment amount DU will use the greater of 10 or 5 of the outstanding balance as the monthly payment when calculating the total debt-to-income ratio. Current Ratio Formula Current Assets Current Liablities.

PRINCIPLES OF MANAGEMENT QUESTION AND ANSWERS Management Question and Answers Phib INTRODUCTION TO MANAGEMENT. As such the expected minimum debt service coverage ratio would be defined as 120 to 10 or alternatively 125 to 10. So we need to take the 5 th value and 6 th value from the data set.

Using the primary quick ratio formula we can calculate Company XYZs acid-test ratio as follows. Its cost of common equity is 14 its before-tax cost of debt is 10 and its marginal tax rate is 40. If for a company current assets are 200 million and current liability is 100 million then the ratio will be 200100 20.

Remember me on this computer. 8 Debt to Equity Ratio DE. Free cash flow 860000 75000.

This is commonly done through finding the debtequity ratio DuPont analysis model etc. 60000 10000 40000 65000 17 This means that for every dollar of Company XYZs current liabilities the firm has 170 of very liquid assets to. How to Calculate the Debt Service Coverage Ratio.

Log in with Facebook Log in with Google. Cash cash equivalents. Directors and High Officials have Ownership interests shares in assets and operation.

1287 Followers 383 Following 29 Posts - See Instagram photos and videos from Abdou A. Add both numbers and divide by 2 to get the median. Liquidity ratios like Current Ratio Current Ratio The current ratio is a liquidity ratio that measures how efficiently a company can repay it short-term loans within a year.

Close Log In. Median 11 2. We calculate it by dividing net sales by the average total assets of a company.

For the debt ratio a lower number is generally better and indicates that the company has more assets than debts ie. The working capital formula is best defined as current assets minus current liabilities. The firm has 576 shares of common stock outstanding that sell for400 per share.

Current Assets Current Liabilities. Current ratio current assetscurrent liabilities read more Quick Ratio Quick Ratio The quick ratio also known as the acid test ratio measures the ability of the company to repay the short-term debts with the help. In other words it aims to measure sales as a percentage of average assets to determine how much sales the company generates.

Since cash flows capital structures and financing methods vary between industries it can be difficult to set a benchmark for what makes a good debt ratio. A corporation is abbreviated as Corp and Incorporation is abbreviated as Inc. Return on Assets ROA is a type of return on investment ROI metric that measures the profitability of a business in relation to its total assets DebtCapital DebtEquity Debt to Equity Ratio The Debt to Equity Ratio is a leverage ratio that calculates the value of total debt and financial liabilities against the total shareholders equity and Interest Coverage ratios.

The expected excess operating income coverage varies however it is usually in the 20 to 25 range. Assume that the firms long-term debt sells at par value. Each of these components is then divided by the businesss revenue.

Median 55 55 is in-between 5 and 6. Enter the email address you signed up with and well email you a reset link. The firms total debt which is the sum of the companys short-term debt and long-term debt equals 1167.

Vertical Analysis refers to checking the different components of a companys income statement. Its current cash debt coverage ratio is 90 which indicates that it can pay off its current liabilities in a given year from its operations. Accounts Payable Accounts Payable Accounts payable is the amount due by a business to its suppliers or vendors for the purchase.

The debt ratio is defined as the ratio of total debt to total assets expressed as a decimal or. In addition its cash debt coverage ratio is also good at 60 which indicates that it can pay off approximately 60 of its debt out of current operations. In order to calculate the debt service coverage ratio you need to know.

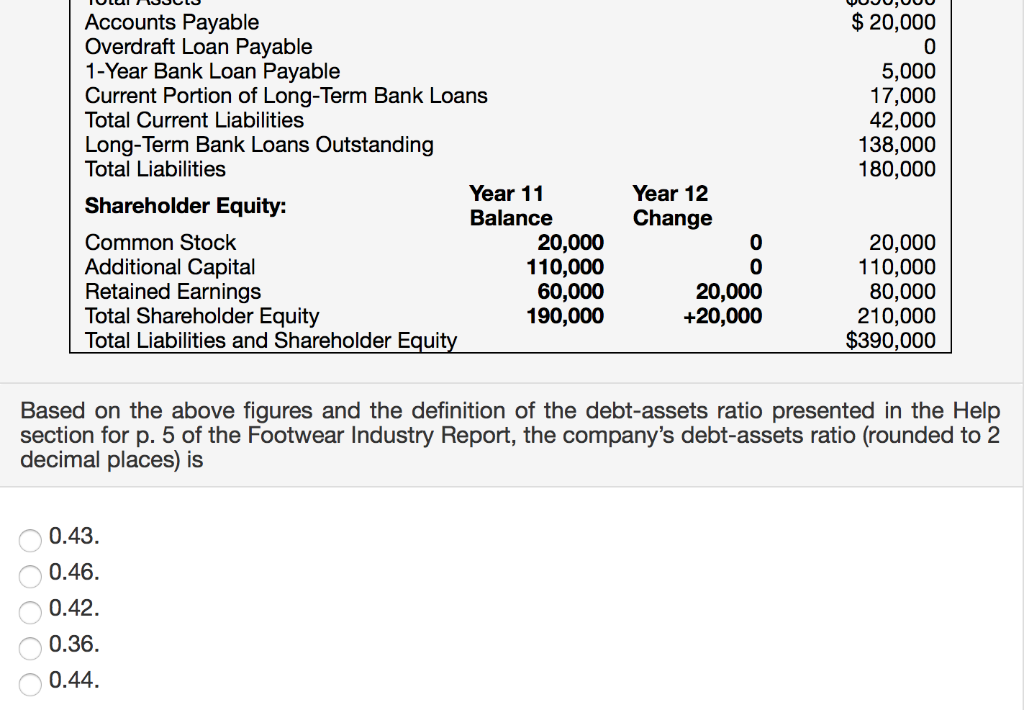

Solved Given The Following Year 12 Balance Sheet Data For A Chegg Com

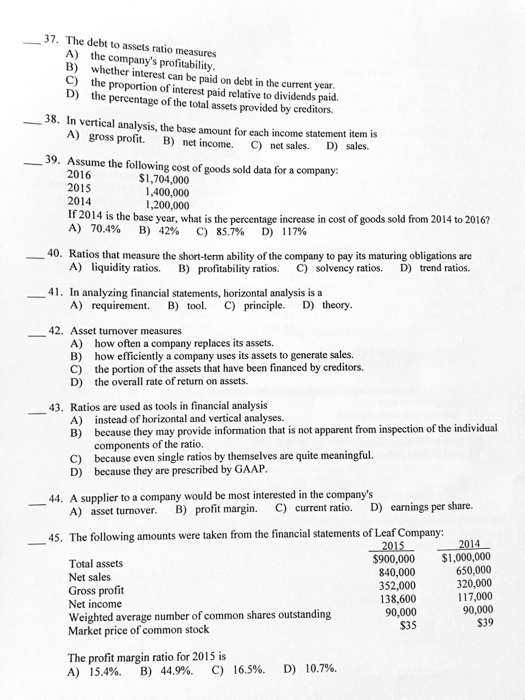

Solved 37 The Debt To Assets Ratio Measures A The Chegg Com

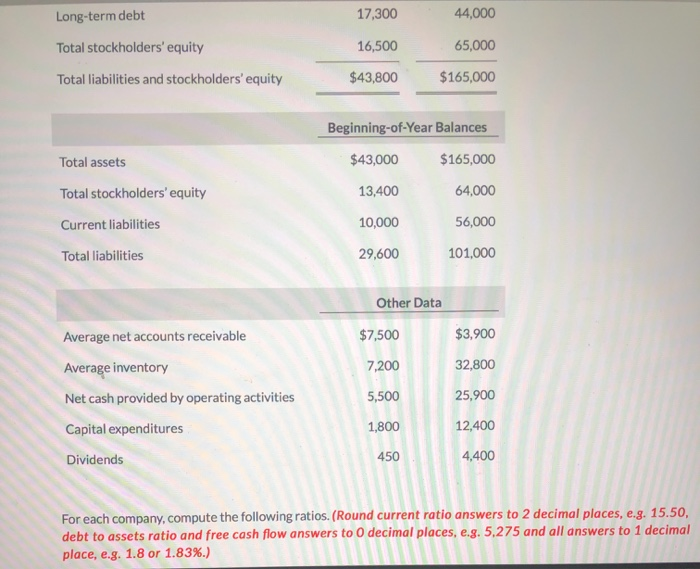

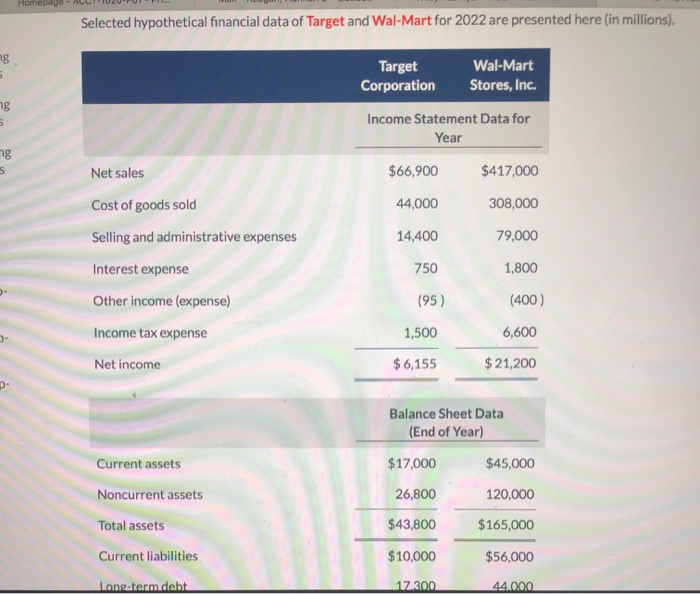

Solved For Each Company Compute The Following Ratios Chegg Com

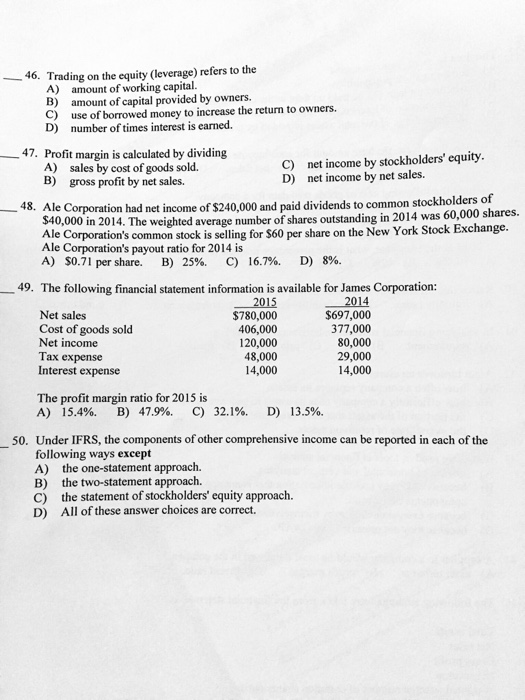

Solved 37 The Debt To Assets Ratio Measures A The Chegg Com

Popular Corporate Finance Interview Questions Interview Questions Management Interview Questions Accounting Interview Questions

Solved For Each Company Compute The Following Ratios Chegg Com

Top 10 Money Questions People Always Ask On Money Q A Money Matters Investing Infographic Budgeting Money

Comments

Post a Comment